Biggest RHS Flower Shows innovations for a generation to reach new audiences and inspire more people to get gardening There

Gardeners’ World Live 2024 returns to the NEC Birmingham from 13-16 June, 2024 and is bringing new highlights as follows:

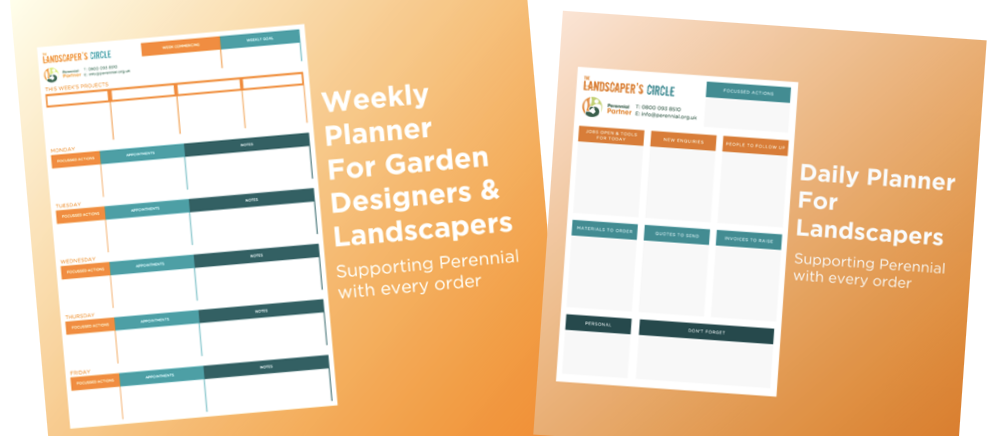

Greg Rhodes talks to general manager of the APL, Phil Tremayne on how best to plan, prepare and cost landscaping

TRADE SHOWS & EVENTS

Subscribe to our newsletter

GROUNDS CARE & TURF

High turf expectations at Northampton Saints

Northampton Saints Rugby Club is one of just three clubs in the Premiership with an

The dawn of a new era in fungicide

Agrovista Amenity has launched Maxtima®, a revolutionary turf fungicide. It heralds a new era in

GKB delivers secondary drainage solutions

GKB Machines has proven to offer the best solutions for secondary drainage for sports construction

Trilo delivers reliability for contractors

Whether it’s for the collection of grass clippings or debris following scarification, or out on

MACHINERY & TOOLS

GreenMech launch new EVO 205TT

It’s rare that any trip to The Arb Show doesn’t unveil something new from GreenMech,

INFINICUT® mowers enter Home Park, Plymouth

A recent upgrade to the mower fleet at Plymouth Argyle Football Club has seen the

Timberwolf Launches TW 280FTR HYBRID Tracked Wood Chipper

As an extension to its hybrid range, wood chippers manufacturer Timberwolf, has launched the TW

Makita XGT range grows

The Makita XGT range is growing as the company has unveiled two additional cordless lawn

ARBORICULTURE

GreenMech EVO 165P exceeds expectations for Wild Arborist

Wild Arborist Toby Lawler has been blown away by the new GreenMech EVO 165P. Growth for

UK Loggers National Championships at SAGE

An exciting two-day competition that will showcase skills and expertise from the best competitive precision

EVO 205D SAFE-Trak added Woodworks fleet

For Nick Hosking it’s Woodworks by name and woodworks by nature as he tackles all

Industry press join GreenMech for update event

Europe’s leading woodchipper manufacturer GreenMech, invited industry media to a hands-on demonstration of some of

TRAINING, EDUCATION & RECRUITMENT

How to attract employees into landscaping

What will attract employees into the world of landscaping and sports turf asks Greg Rhodes

Garden design school celebrates first year

The Yorkshire School of Garden Design has celebrated its first anniversary with an exhibition showcasing

GGM launch LANTRA accredited training academy

GGM Groundscare have unveiled a new LANTRA accredited training academy as the latest offering to

Garden design sketch course

The Yorkshire School of Garden Design is launching an expertly-led aspirational course to equip budding